Elon Musk’s Net Worth in Rupees. This Trying to comprehend the wealth of Elon Musk using the US dollar is a challenge for many. Converting that fortune into Indian rupees, however, transforms an abstract astronomical figure into a more visceral, staggering reality. We are no longer just talking about billions; we are talking about lakhs of crores a denomination that resonates profoundly in the Indian subcontinent. This article is your definitive guide to understanding the Elon Musk net worth in rupees, not as a static number, but as a dynamic, living entity shaped by rocket launches, stock market frenzies, and visionary gambles. We will dissect the origins of this wealth, its incredible volatility, and what a fortune measured in over ten lakh crore rupees truly means in a global and Indian context. Buckle up, as we embark on a journey to quantify the ambition of our era’s most audacious industrialist.

The Foundation of a Fortune: From Zip2 to PayPal

Elon Musk’s journey to accumulating his monumental net worth in rupees began not with rockets or electric cars, but with the internet boom of the late 1990s. His first major venture, Zip2, was an online city guide software for newspapers, co-founded with his brother Kimbal. Compaq acquired Zip2 in 1999 for approximately $307 million in cash and stock, netting the young Musk around $22 million. He immediately plowed a significant portion of this capital into his next venture, an online financial services company called would eventually become PayPal after a merger. Despite internal conflicts that led to Musk being ousted as CEO, the PayPal chapter was a foundational wealth event. When eBay acquired PayPal in 2002 for $1.5 billion in stock, Musk, as the largest shareholder with 11.7% of the company, received over $165 million. This capital provided the essential fuel the initial “propellant,” if you will for his seemingly impossible dreams in space exploration and sustainable transport. It was this liquidity that allowed him to make the pivotal, high-risk investments that would later define his empire and, consequently, his net worth measured in rupees.

The Tesla Transformation: Equity and Valuation

While Musk did not found Tesla, his involvement as a lead investor and eventual CEO fundamentally redirected the company’s course and became the single largest engine of his wealth. His initial $6.5 million investment in 2004 gave him a controlling stake and the chairmanship. More importantly, his vision for Tesla evolved it from a niche electric roadster manufacturer into a full-scale automotive and energy company. The value creation here is primarily tied to his massive equity stake in Tesla, which has undergone multiple stock splits, making the shares more accessible and further fueling investor enthusiasm.

Tesla’s market valuation has experienced meteoric rises and painful corrections, each swing moving Musk’s personal net worth in rupees by lakhs of crores. His compensation package, the largest in corporate history, is entirely performance-based, granting him stock option tranches as Tesla hits specific market capitalization and operational milestones. This structure directly aligns his personal fortune with shareholder value, for better or worse. As Tesla succeeded in scaling production, achieving profitability, and dominating the EV market, its market cap soared, transforming Musk’s equity from a valuable asset into the cornerstone of his status as the world’s richest person.

SpaceX: The Privately Held Juggernaut

Unlike Tesla, SpaceX remains a privately held company, but its valuation growth is no less spectacular and is a critical, though less liquid, pillar of Musk’s wealth. Founded with the Mars-colonizing goal of making life multi-planetary, SpaceX revolutionized the aerospace industry with reusable rocket technology. Its Falcon 9 and Falcon Heavy rockets decimated launch costs, while the Starlink satellite internet constellation represents a potentially massive recurring revenue stream. Each successful funding round has seen SpaceX’s valuation climb exponentially, from early rounds in the hundreds of millions to over $180 billion in recent years.

Musk’s majority ownership stake in SpaceX means that every valuation jump directly increases his theoretical net worth. However, because the shares are not publicly traded, this portion of his wealth is less transparent and less easily converted to cash without a sale or public offering. Analysts must estimate its contribution based on funding round prices. This private company’s wealth adds a layer of stability and future growth potential to his portfolio, ensuring that even if Tesla’s stock fluctuates, his overall net worth in Indian rupees is supported by another industry-defining titan.

The Volatile Nature of Mega-Wealth

A key misconception about ultra-high net worth individuals like Musk is that their wealth is a stable bank balance. In reality, it is an incredibly volatile figure, akin to a seismic reading during an earthquake. The vast majority of his fortune is tied to the stock prices of Tesla and, to a lesser extent, the private valuation of SpaceX. A 5% swing in Tesla’s share price, a common daily occurrence, can change the value of his holdings by billions of dollars translating to tens of thousands of crores of rupees in mere hours.

This volatility was starkly displayed in 2022, when concerns over Twitter acquisition financing and broader market downturns saw Musk’s total net worth drop by over $100 billion in a year. Conversely, bull runs can create wealth just as rapidly. This means the quoted Elon Musk net worth in rupees on any given day is a snapshot, not a permanent record. It is a live reflection of market sentiment, investor confidence in his companies’ futures, and global macroeconomic conditions. His wealth is less a monument and more a high-energy particle in a financial accelerator.

Calculating the Conversion: Dollars to Rupees

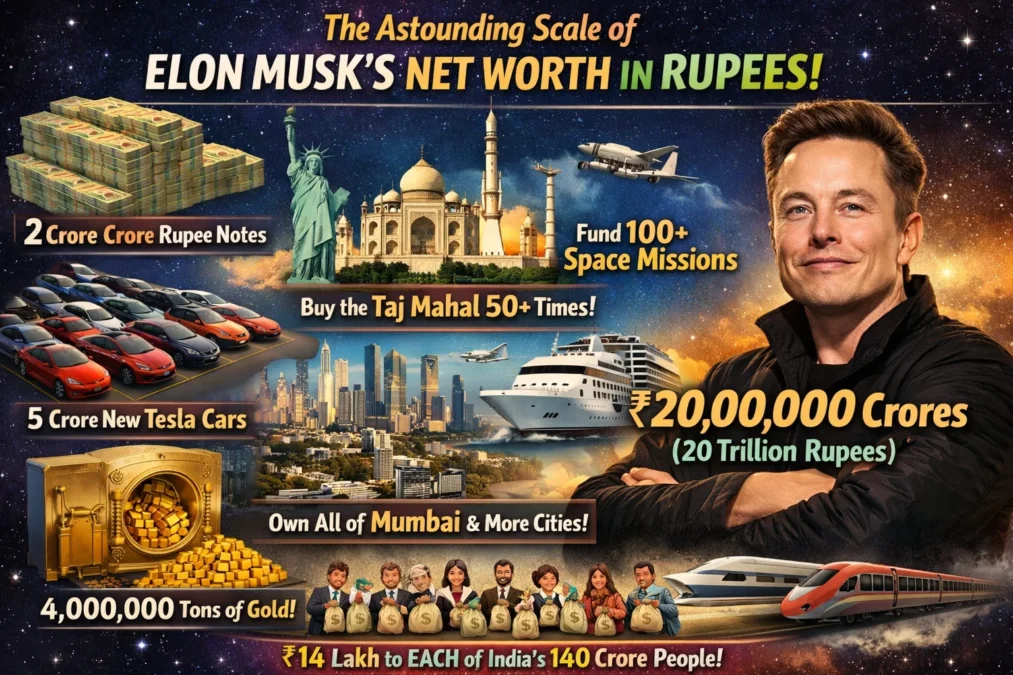

To accurately convert Elon Musk’s wealth into Indian currency, one must use real-time foreign exchange rates and the latest valuations of his public assets. The process starts with aggregating his known holdings: primarily his Tesla stock, his SpaceX stake (based on the latest private valuation), and his positions in other ventures like The Boring Company and Neuralink. This total in US dollars is then multiplied by the current USD/INR exchange rate, which itself fluctuates daily based on economic factors between the two nations.

For illustrative purposes, let’s consider a hypothetical snapshot. If Elon Musk’s total estimated net worth is $220 billion and the USD/INR exchange rate is 83, the calculation is straightforward: 220,000,000,000 * 83 = ₹18,260,000,000,000. That is over 18.26 lakh crore Indian rupees. It is crucial to use a reputable financial data source for the dollar net worth and a live forex rate for the conversion to ensure the resulting figure for Elon Musk’s net worth in rupees is as accurate as possible at that moment in time.

A Comparative Lens: Global Wealth in Indian Terms

To truly grasp the scale of ₹18 lakh crore, it helps to place it beside familiar benchmarks. Consider India’s annual budget for key ministries, the market capitalization of its largest companies, or the fortunes of its own business titans. The exercise is humbling. Musk’s wealth in rupees could fund the entire Indian space program, ISRO, for decades. It surpasses the market cap of giants like Reliance Industries or TCS, which are pillars of the Indian economy, employing hundreds of thousands.

Even compared to other global billionaires, the scale is distinct. While Bernard Arnault or Jeff Bezos have comparable dollar figures, converting them to rupees consistently yields numbers in the same stratospheric league of lakhs of crores. This comparison underscores how the converted net worth of Elon Musk in rupees represents not just individual success but a concentration of capital equivalent to the value of entire national industries. It frames his economic influence in a context that is immediately relatable to the Indian audience.

The Compensation Package That Built a Fortune

A pivotal element in Musk’s wealth accumulation is his unprecedented 2018 CEO performance award from Tesla. This is not a salary or a bonus; it is a purely aspirational, moonshot incentive structure. The package granted Musk the option to buy Tesla stock at a heavily discounted price if the company achieved a series of escalating market capitalization and operational milestones, starting at $100 billion and going up to $650 billion. Each tranche represented 1% of Tesla’s outstanding shares at the time of the grant.

Tesla’s stunning market success led to the rapid hitting of all twelve milestones. As each tranche vested, Musk gained the right to purchase millions of shares at a fraction of their market value. The paper gains from exercising these options is immense. This mechanism is why his net worth in rupees is so intimately and explosively tied to Tesla’s market performance. It was a high-stakes bet that aligned his payout with creating immense shareholder value, a bet that paid off on a scale never before seen in corporate history.

Beyond Tesla and SpaceX: The Other Ventures

While Tesla and SpaceX form the twin pillars, Musk’s financial ecosystem includes other ambitious ventures that contribute to his overall wealth profile. Neuralink, focused on developing brain-computer interfaces, and The Boring Company, aimed at tunnel-based transportation solutions, are both privately held. Their valuations, while smaller than SpaceX’s, add billions to his net worth estimate. Then there is X (formerly Twitter), an acquisition that stands apart. Musk purchased X for $44 billion, largely financing it by selling Tesla stock and taking on debt.

Currently, most analysts believe X’s market value has fallen significantly since the purchase, making it a detractor from, rather than a contributor to, his peak net worth. However, if Musk’s vision to transform it into an “everything app” succeeds, it could become a valuable asset. These ventures demonstrate that his total net worth in rupees is a composite of both staggering successes and high-profile, high-risk bets that are still in the proving ground phase. They reflect an investment philosophy centered on solving fundamental human challenges.

Philanthropy and the Musk Foundation

With great wealth comes scrutiny of its application for social good. Musk’s primary philanthropic vehicle is the Musk Foundation. Its focus has been on renewable energy research, human space exploration, pediatric research, and developing safe artificial intelligence. However, when viewed as a percentage of his net worth, his charitable donations have been notably lower than those of peers like Warren Buffett or even the Gates Foundation during its most active giving periods.

Musk has often stated that he believes the best use of his capital is to reinvest it in companies that actively work on solving humanity’s big problems like accelerating the transition to sustainable energy with Tesla or ensuring a multiplanetary future with SpaceX. In his view, this is a form of philanthropy. This philosophy means a smaller portion of his multi-lakh crore rupee net worth is directed to traditional charitable grants, a point of frequent discussion and critique in analyses of how the ultra-wealthy deploy their resources.

Market Forces and Macroeconomic Impact

The fortune of Elon Musk does not exist in a vacuum. It is exquisitely sensitive to global macroeconomic winds. Interest rate hikes by the US Federal Reserve, which make borrowing more expensive and can depress growth stock valuations, directly impact Tesla’s share price. Geopolitical tensions, supply chain disruptions for critical components like batteries, and global EV adoption rates all feed into the financial performance of his primary asset.

Furthermore, Musk’s own actions and statements can move markets. A tweet about taking Tesla private in 2018 led to regulatory sanctions. His polls and pronouncements on cryptocurrency have caused price swings. This creates a feedback loop where the man influences the very markets that determine his wealth. Therefore, tracking Elon Musk’s net worth in rupees requires an understanding of far more than just corporate earnings; it demands awareness of global finance, geopolitics, and even social media sentiment.

The Psychological and Societal Perspective

Wealth of this magnitude challenges our psychological and societal frameworks for understanding value, success, and inequality. For most people, crores of rupees represent a life-changing, generational sum. Lakhs of crores are cognitively ungraspable they belong to the realm of national budgets and astronomical distances. This scale inevitably sparks debates about wealth concentration, tax policy, and the power wielded by individuals in a globalized economy.

Musk’s net worth in Indian rupees symbolizes the extreme potential of leveraged technology, vision, and risk-taking in the 21st century. It raises questions: Is this level of individual wealth a sign of a healthy, innovative economy or a systemic imbalance? Does it empower one person to drive progress in directions that bypass democratic or collective decision-making? The number itself is neutral, but the reactions it elicits awe, inspiration, criticism, or concern reflect our deepest beliefs about capital, merit, and the future we are building.

Future Trajectory: What Could Change the Number?

Predicting the future of such a dynamic figure is fraught with uncertainty, but several clear catalysts could drastically alter Elon Musk’s Net Worth in Rupees. Positive drivers include the successful full rollout and profitability of Tesla’s Full Self-Driving software, the commencement of SpaceX’s Starship operational flights (potentially for Starlink, NASA missions, or point-to-point Earth travel), and a successful turnaround and monetization of the X platform. Each could unlock trillions of rupees in new value.

Conversely, significant risks abound. Intensified competition in the EV market could erode Tesla’s margins and dominance. A failure in a key Starship test program could delay SpaceX’s ambitions and hurt its valuation. Regulatory interventions, either in the form of new wealth taxes or antitrust actions, could directly impact his holdings. Most dramatically, if Musk were to decide to liquidate a large portion of his Tesla stock to fund other ventures, the selling pressure could depress the share price, creating a self-reinforcing downward cycle in his net worth.

Elon Musk Net Worth Breakdown: A Snapshot Analysis

The table below provides a simplified, illustrative breakdown of the primary components that constitute Elon Musk’s wealth. It highlights the asset class and liquidity of each component, which is crucial for understanding that his “net worth” is not readily spendable cash.

| Asset / Company | Estimated Value (in USD Billions) | Primary Contribution to Net Worth | Liquidity & Notes |

|---|---|---|---|

| Tesla Stock & Options | ~$110 – $150 B | Equity ownership & vested options. Largest single asset. | Highly volatile. Liquid only upon sale, which can impact market price. |

| SpaceX Equity | ~$70 – $100 B | Majority ownership stake in the private aerospace company. | Illiquid. Value based on latest private funding rounds. No public market. |

| The Boring Company | ~$5 – $7 B | Majority stake in the tunnel infrastructure venture. | Very illiquid. Private valuation. |

| Neuralink | ~$3 – $5 B | Majority stake in the brain-computer interface startup. | Very illiquid. Private valuation. |

| X (formerly Twitter) | ~$15 – $25 B | 100% ownership after the 2022 acquisition. | Illiquid. Considered by many analysts to be worth less than purchase price. |

| Cash & Other Assets | ~$5 – $10 B | Proceeds from past stock sales, personal investments. | Highly liquid. Used for financing purchases (e.g., Twitter) and taxes. |

As the renowned financial analyst and author of “The Psychology of Money,” Morgan Housel, once observed: “The highest form of wealth is the ability to wake up every morning and say, ‘I can do whatever I want today.’” While we quantify Musk’s power in rupees, this quote reminds us that the ultimate value of such a fortune may lie in the unprecedented agency it provides to shape the future according to one’s own vision for better or worse.

Conclusion

Ultimately, tracking Elon Musk’s net worth in rupees is about more than voyeurism into extreme wealth. It is a live case study in modern value creation, where vision, technology, and capital intersect on a global scale. The number, often hovering around 18 to 20 lakh crore rupees, is a dynamic scorecard for his companies’ perceived future. It reflects bets on electric vehicles, space exploration, and the digital public square. This fortune, volatile and tied to the fate of transformative industries, underscores a new era where individuals can command resources rivaling nations. For observers, entrepreneurs, and economists alike, it serves as a powerful, ongoing narrative about risk, innovation, and the staggering financial magnitudes possible in the 21st century.

Frequently Asked Questions (FAQs)

How is Elon Musk’s net worth in rupees calculated?

The calculation involves taking his latest estimated total net worth in US dollars, which is primarily the sum of his holdings in Tesla, SpaceX, and other ventures, and multiplying it by the current US Dollar to Indian Rupee (USD/INR) exchange rate. This yields the Elon Musk net worth in rupees, a figure that changes daily with stock prices and forex fluctuations.

What is the single biggest source of Elon Musk’s wealth?

The single biggest source is his stake in Tesla, Inc. This includes both his direct ownership of hundreds of millions of shares and the massive stock option package he earned by hitting performance milestones. Fluctuations in Tesla’s stock price are the most direct and immediate cause of changes in its overall net worth converted to rupees.

Has his net worth ever decreased significantly?

Yes, dramatically so. In 2022, amid a broader tech stock sell-off and concerns related to his acquisition of Twitter, Musk’s net worth dropped by over $100 billion from its peak. In rupee terms, this represented a loss of lakhs of crores, demonstrating the highly volatile nature of wealth tied to public market valuations.

How does his wealth in rupees compare to that of India’s richest person?

The scale is entirely different. As of current estimates, Elon Musk’s wealth is multiple times larger than that of Mukesh Ambani, India’s richest individual. Musk’s fortune, often exceeding ₹18 lakh crore, is in a league that compares to the total market capitalization of India’s largest companies, whereas Ambani’s wealth, while immense, is measured in lakhs of crores as well, but on a lower scale.

Does Elon Musk actually have this amount in cash?

Absolutely not. The vast majority of his record net worth in rupees is “paper wealth” tied to the value of his company shares. To access it as liquid cash, he would have to sell those shares, which would be a complex, market-moving process subject to capital gains taxes. His spendable cash is a tiny fraction of the total headline figure.

You May Also Read

WeFunder Reviews: An Unvarnished Look at the Good, The Bad, and The Future of Crowdfunding